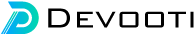

Mastering the Inverse Head and Shoulders Pattern: A Comprehensive Guide

How To Use the .htaccess File

Back to Top Button using jQuery and CSS

Express JS tutorial for beginners

Smooth Scroll to Div using jQuery

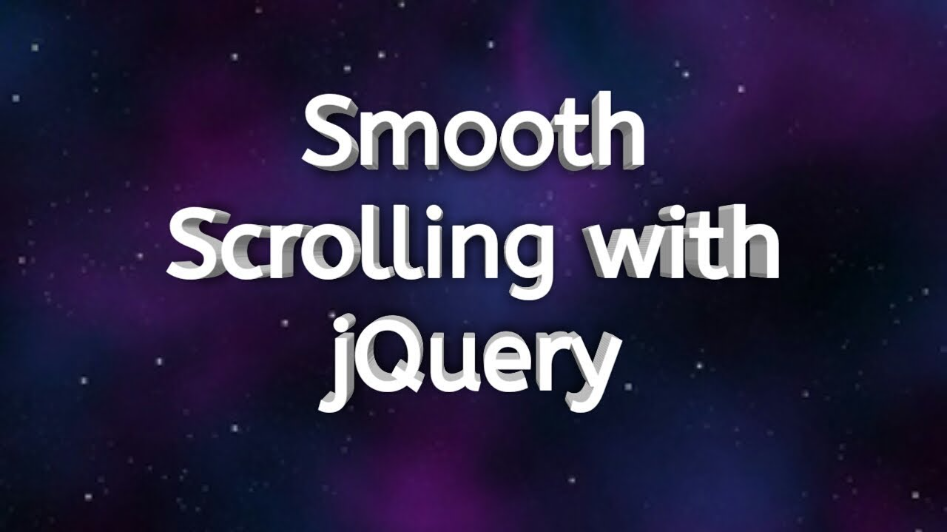

Create a Responsive Navbar using ReactJS

What is a Hardware Wallet and How Does it Work?

What is a Hardware Wallet? In the realm of cryptocurrency storage, two primary types of wallets exist: software-based hot wallets and physical cold wallets. #HardwareWallets, categorized as cold wallets, stand out as one of the most secure methods for safeguarding cryptocurrencies. These devices store private keys externally in a physical device, often a USB or Bluetooth device.

Before delving into hardware wallets, it's crucial to grasp the significance of public and private keys.

How Does a Hardware Wallet Work? Hardware wallets do not store the cryptocurrency itself but rather the keys required to access it. The foundation lies in public and private key pairs, integral to public key cryptography—an encryption mechanism ensuring data security. The keys, comprising long strings of numbers, encrypt and decrypt messages and transactions.

Private keys, as alphanumeric codes, grant access to cryptocurrency transactions without the need for third-party verification. They embody final ownership and control over one's cryptocurrency, aligning with the trustless nature of blockchain technology. Maintaining the confidentiality of private keys is paramount to prevent unauthorized access and transactions.

Where to Store Private Keys? Cold Wallets. Several secure options exist for storing private keys:

- #HardwareWallets: Widely regarded as the most secure, these physical devices keep private keys offline.

- Encrypted Storage Devices: Offline flash drives serve as a temporary solution for those not opting for hardware wallets.

- Paper Wallets: While less secure than hardware wallets, paper wallets, with keys printed on paper, can be laminated and stored in a safe for enhanced security.

- Stainless Steel: To mitigate risks of damage due to fire or flood, engraving private keys on stainless steel provides durability.

Now, let's delve deeper into the popular method of storing private keys—hardware wallets.

How to Use a Hardware Wallet:

- Connect the hardware wallet to a computer or smartphone.

- Set a PIN code during the device setup for an added layer of security.

- The wallet's app generates a wallet address (public key) for sending and receiving crypto.

- When sending tokens, confirm the transaction by physically inputting the PIN on the device.

- Wait for confirmation of the transaction.

Benefits of a Hardware Wallet:

- Control: Full ownership and control of funds with private key management.

- Maximum Security: Offline private key storage makes hardware wallets highly secure.

- Backup Options: Recovery seed phrases allow the regeneration of private keys if the wallet is lost.

Disadvantages of a Hardware Wallet:

- Upfront Cost: Hardware wallets can be expensive.

- User Experience: Setup may be cumbersome for beginners.

- Accessibility: Less convenient for daily transactions, more suitable for long-term asset holding.

Choosing a Hardware Wallet: Consider the following factors:

- Security features

- Interface and ease of use

- Supported currencies

- Supported operating systems

- Platform compatibility

- Portability

- Reputation of the wallet maker

The Best Hardware Wallets: Popular choices include Ledger and BC Vault. #Crypto.com has also collaborated with CoolBitX on a limited-edition hardware wallet.

Final Thoughts - Do You Need a Hardware Wallet? While hardware wallets offer high security, they may not be suitable for everyone, especially beginners. Their setup and operations may be complex, requiring regular backup. If peace of mind and long-term asset holding are priorities, a hardware wallet is an excellent choice.

#DueDiligence #Research #CryptoInvesting #CryptocurrencyEducation

Important Disclaimer: The information provided here is for informational purposes only, not financial advice. Users should conduct thorough research and due diligence before making any crypto-related decisions. Past performance does not guarantee future results, and crypto investments carry inherent risks.

Recent Posts

Mastering the Inverse Head and Shoulders Pattern: A Comprehensive Guide

What are penny stocks, and is it wise to invest in them?

Understanding Average Stock Market Returns and Investment Strategies

Smooth Scroll to Div using jQuery

Back to Top Button using jQuery and CSS

How to install Tailwind CSS in React

How To Use the .htaccess File

What is a Hardware Wallet and How Does it Work?

A Complete Overview of Web3 Wallets and How Does It Work?

Create a Responsive Navbar using ReactJS

Express JS tutorial for beginners

Create a Responsive Navbar using ReactJS

GTA 6 Trailer 2025: Explore Vice City with Lucia - Everything We Know So Far

What is a Hardware Wallet and How Does it Work?

You may also like…