What are penny stocks, and is it wise to invest in them?

How To Use the .htaccess File

Smooth Scroll to Div using jQuery

How to install Tailwind CSS in React

GTA 6 Trailer 2025: Explore Vice City with Lucia - Everything We Know So Far

Express JS tutorial for beginners

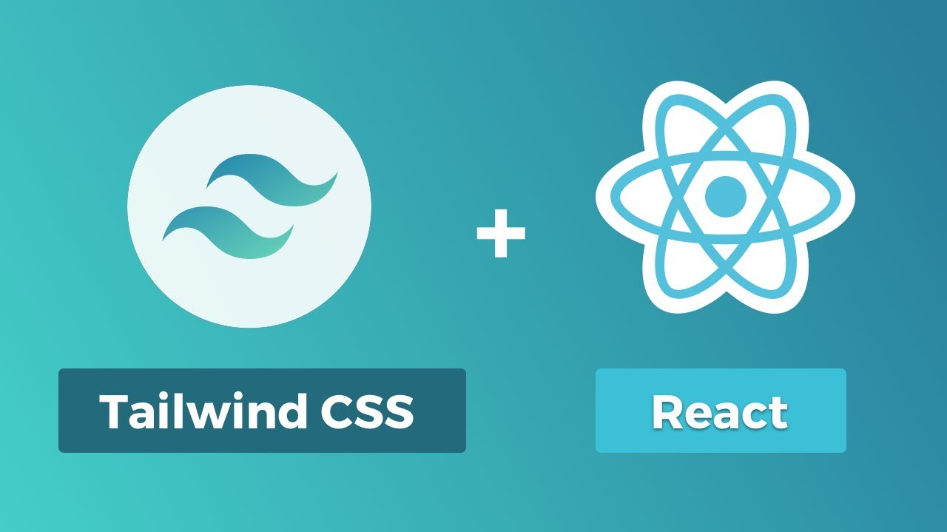

Mastering the Inverse Head and Shoulders Pattern: A Comprehensive Guide

This guide delves into the inverse head and shoulders chart pattern, a powerful tool for identifying potential trend reversals in downtrends. By understanding the components, formation, and trading strategies associated with this pattern, traders can enhance their decision-making processes.

Components of an Inverse Head and Shoulders Pattern:

Lead-in Downtrend:

The pattern typically emerges after a clear downward trend characterized by lower lows and lower highs, setting the stage for a potential reversal.

Inverse Head and Shoulders Formation:

The core of the pattern involves a sequence of a low (left shoulder), a lower low (head), and a higher low (right shoulder), creating a resistance level known as the neckline.

Reversal Breakout (Neckline Resistance):

A bullish breakout above the neckline signals the potential trend reversal. The psychology behind this shift lies in the diminishing aggression of sellers (bears) and the increasing aggression of buyers (bulls).

How to Trade an Inverse Head and Shoulders Pattern:

Identify the Pattern:

Recognize the lead-in downtrend, the inverse head and shoulders formation, and anticipate the potential breakout above the neckline.

Determine the Breakout Point (Neckline):

Identify the breakout point by drawing a line connecting the highs leading to the shoulder lows. Set alerts for price movements around this crucial level.

Enter the Trade:

Enter the trade upon the occurrence of the inverse head and shoulders pattern. Buying on the breakout or a retest of the neckline as support are optimal entry points.

Exit the Trade:

Place a stop-loss below the breakout resistance to mitigate risks. Profit targets may vary, commonly aligning with upcoming resistance levels or psychological price points.

Tips for Trading Inverse Head and Shoulders Patterns:

Look for Volume on the Breakout:

High volume confirms a strong buying pressure, validating the trend reversal. Low volume may indicate a short-lived breakout.

If You Miss Your Entry, Wait for a Retest:

A retest of the breakout price as support signals the continued strength of the bullish trend.

Don't Be Early:

Wait for the confirmation of the right shoulder formation and the breakout above the neckline before entering a long position.

Consider the Full Picture:

Supplement the inverse head and shoulders pattern analysis with broader market performance, support/resistance levels, company news, sentiment, and additional technical indicators.

Frequently Asked Questions (FAQ):

Q: What is an inverse head and shoulders pattern?

- A: It is a bullish trend reversal pattern signaling a potential shift in a downtrend.

Q: What is the difference between an inverse head and shoulders pattern and a regular head and shoulders pattern?

- A: The inverse pattern is bullish, occurring in a downtrend, while the regular pattern is bearish, occurring in an uptrend.

Q: What negates an inverse head and shoulders pattern?

- A: A failed breakout (inability to break above the neckline resistance) nullifies the pattern.

Q: How do you trade the inverse head and shoulders pattern?

- A: Buy on the breakout or a retest of the neckline, with a stop-loss below the breakout resistance and profit targets set at upcoming resistance levels.

Recent Posts

Mastering the Inverse Head and Shoulders Pattern: A Comprehensive Guide

What are penny stocks, and is it wise to invest in them?

Understanding Average Stock Market Returns and Investment Strategies

Smooth Scroll to Div using jQuery

Back to Top Button using jQuery and CSS

How to install Tailwind CSS in React

How To Use the .htaccess File

What is a Hardware Wallet and How Does it Work?

A Complete Overview of Web3 Wallets and How Does It Work?

Create a Responsive Navbar using ReactJS

Express JS tutorial for beginners

Express JS tutorial for beginners

Mastering the Inverse Head and Shoulders Pattern: A Comprehensive Guide

Back to Top Button using jQuery and CSS

You may also like…