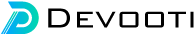

Mastering the Inverse Head and Shoulders Pattern: A Comprehensive Guide

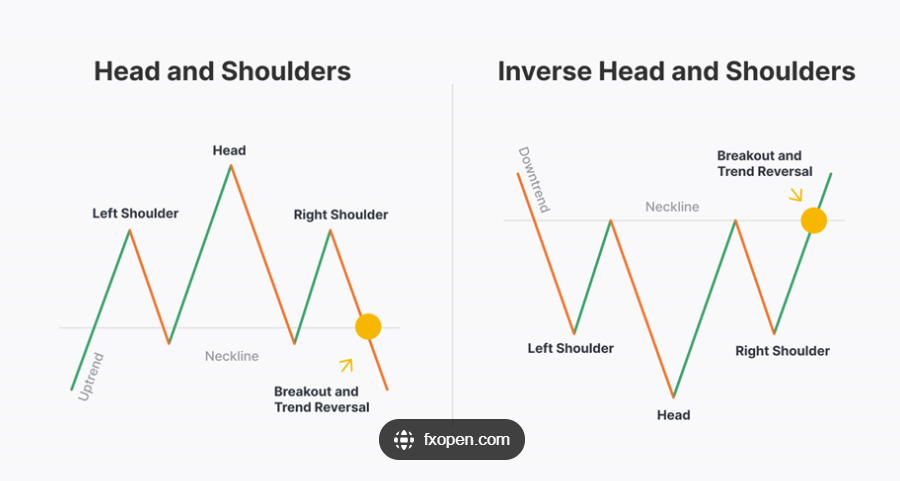

Create a Responsive Navbar using ReactJS

Express JS tutorial for beginners

GTA 6 Trailer 2025: Explore Vice City with Lucia - Everything We Know So Far

Back to Top Button using jQuery and CSS

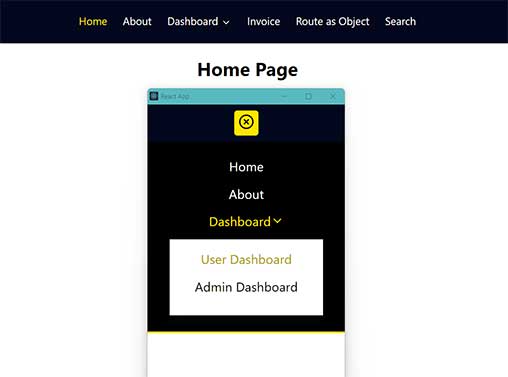

How to install Tailwind CSS in React

What are penny stocks, and is it wise to invest in them?

Penny stocks, characterized by their low share prices, may seem attractive due to their apparent affordability. However, these stocks can be risky investments, often leading to unexpected losses for investors. In this discussion, we delve into what defines a penny stock, the associated risks, and the myths that can mislead potential investors.

What Constitutes a Penny Stock?

Penny stocks typically trade at prices below $5 per share, with a common reference being those below a dollar. These stocks are frequently not listed on major exchanges like the NYSE or Nasdaq, instead finding a place on the pink sheets or the over-the-counter (OTC) market. The lack of listing on major exchanges contributes to a lack of transparency regarding financials and governance, making due diligence challenging for investors.

The Risky Nature of Penny Stocks

Penny stocks encompass both promising startups and dubious enterprises, including potential frauds and pump-and-dump schemes. The speculative and illiquid nature of these stocks, coupled with limited regulatory oversight, amplifies the risk for investors. The Securities and Exchange Commission (SEC) acknowledges the high-risk nature of penny stocks, cautioning investors about the possibility of losing their entire investment or more, especially if purchased on margin.

Can You Profit from Penny Stocks?

While it is possible to make money with penny stocks, success requires the ability to analyze companies effectively. Investors need to distinguish between sound businesses and potential frauds. Keeping abreast of financial statistics, emerging news, and SEC filings is crucial. However, relying solely on promises of breakthrough technologies or exaggerated claims can lead to significant losses.

Common Myths Surrounding Penny Stocks

Several misconceptions surround penny stocks, contributing to misguided investment decisions. It is essential to debunk these myths to make informed choices:

Myth: Penny stocks have high potential, but they're undiscovered

- Reality: While a few may have potential, most trade at low prices due to poor business performance or fraudulent activities.

Myth: If the stock goes up just $1, I'll double my money

- Reality: Stocks rise based on profitability and future expectations. Penny stocks rarely sustain the kind of growth needed for substantial returns.

Myth: This $1 stock is cheaper than that $100 stock

- Reality: Professional investors assess stock value based on earnings metrics, not just share price. A profitable $200 stock can be cheaper than an unprofitable penny stock at any price.

Conclusion

Investing in penny stocks requires exceptional analytical skills to navigate the inherent risks. For those lacking expertise, opting for well-established businesses or diversified index funds may offer a more secure investment strategy. Understanding the risks and debunking myths is essential for any investor considering venturing into the world of penny stocks.

Recent Posts

Mastering the Inverse Head and Shoulders Pattern: A Comprehensive Guide

What are penny stocks, and is it wise to invest in them?

Understanding Average Stock Market Returns and Investment Strategies

Smooth Scroll to Div using jQuery

Back to Top Button using jQuery and CSS

How to install Tailwind CSS in React

How To Use the .htaccess File

What is a Hardware Wallet and How Does it Work?

A Complete Overview of Web3 Wallets and How Does It Work?

Create a Responsive Navbar using ReactJS

Express JS tutorial for beginners

How to install Tailwind CSS in React

How To Use the .htaccess File

What are penny stocks, and is it wise to invest in them?

You may also like…