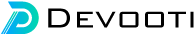

Mastering the Inverse Head and Shoulders Pattern: A Comprehensive Guide

Smooth Scroll to Div using jQuery

A Complete Overview of Web3 Wallets and How Does It Work?

How to install Tailwind CSS in React

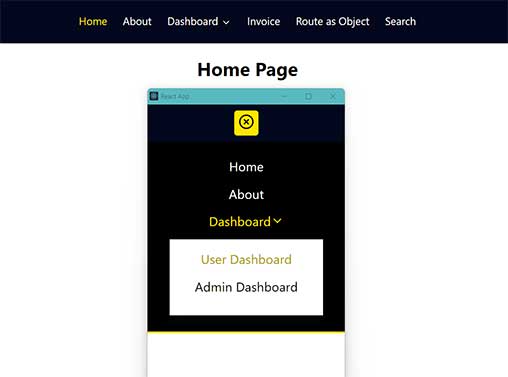

Create a Responsive Navbar using ReactJS

Back to Top Button using jQuery and CSS

A Complete Overview of Web3 Wallets and How Does It Work?

Overview

In the realm of cryptocurrencies and blockchain-based applications, Web3 wallets have become indispensable tools. These wallets facilitate the secure storage, management, and transfer of digital assets, catering to the growing demand driven by decentralized applications (dApps). This guide will delve into the definition of Web3 wallets, the various types available, and essential security measures.

Understanding Web3 Wallets

Web3 wallets are digital wallets specifically crafted for interacting with Web3 applications, decentralized applications built on blockchain technology. These wallets empower users to store and manage diverse digital assets, including cryptocurrencies, NFTs, and other digital tokens.

Types of Web3 Wallets

There are three primary types of Web3 wallets: non-custodial, custodial, and smart contract wallets.

Non-custodial Wallets

Non-custodial, or self-custody, wallets rely on a public and private key pair to grant users complete control over their assets. The public key serves as a unique identifier for receiving assets, while the private key, akin to a house key, is crucial for signing transactions on the blockchain. Non-custodial wallets can be classified as hot wallets when connected to the internet (e.g., browser extensions or mobile apps) or cold wallets when stored offline on physical devices (e.g., Ledger, Trezor).

Custodial Wallets

Contrastingly, custodial wallets involve a third party, such as an exchange (e.g., Coinbase), managing the private keys on behalf of users. These wallets often require KYC (know-your-customer) and trust in the third party, which assumes responsibility for private keys. Custodial wallets may offer features similar to non-custodial wallets, including interaction with smart contracts.

Smart Contract Wallets

Managed by smart contracts on blockchain networks, smart contract wallets offer a unique layer of security through programmed logic, potentially requiring multiple signatures for added redundancy. These wallets allow users to define recovery mechanisms within the smart contract, enhancing security. Smart contract wallets are suitable for entities needing multi-party approval for transactions.

Choosing the Right Web3 Wallet

The choice of Web3 wallet depends on factors like expertise, desired control over assets, and trust in third parties. Non-custodial wallets are ideal for those seeking complete control, while custodial wallets suit newcomers to the space. Smart contract wallets cater to businesses or organizations requiring multi-party transaction approval.

Popular Web3 Wallets

Numerous Web3 wallets exist, each with distinct features. Some notable options include MetaMask, Phantom, MyEtherWallet, Trust Wallet, Torus, Coinbase Wallet, Coinbase, Binance, Safe, Argent, and Squads. Users should research and select a wallet aligning with their needs, security requirements, and functionality preferences.

Securing Your Wallet

Web3 wallets, holding valuable digital assets, are prime targets for hackers. Implementing best practices is crucial for maintaining security:

- Keep private keys safe: Store private keys securely and avoid sharing them.

- Use two-factor authentication (2FA): Enable 2FA for an additional layer of security, especially for custodial wallets.

- Keep software updated: Regularly update wallet software to benefit from security patches.

- Consider hardware wallets: Opt for hardware wallets for offline storage, deemed the most secure method.

- Beware of phishing attacks: Exercise caution with unsolicited messages requesting private keys or personal information.

QuickNode and Web3 Wallets

QuickNode offers reliable blockchain infrastructure for Web3 wallets, facilitating swift and efficient interactions with the blockchain. With API access across multiple blockchains, QuickNode provides fast and dependable transaction services, alongside data analytics and monitoring for real-time insights.

Final Thoughts

Web3 wallets play a vital role for users engaging with blockchain applications, ensuring secure storage and control over digital assets. When selecting a Web3 wallet, factor in expertise, control preferences, and trust considerations. Adhering to best practices enhances wallet security, safeguarding digital assets in the evolving landscape of blockchain technology.

Recent Posts

Mastering the Inverse Head and Shoulders Pattern: A Comprehensive Guide

What are penny stocks, and is it wise to invest in them?

Understanding Average Stock Market Returns and Investment Strategies

Smooth Scroll to Div using jQuery

Back to Top Button using jQuery and CSS

How to install Tailwind CSS in React

How To Use the .htaccess File

What is a Hardware Wallet and How Does it Work?

A Complete Overview of Web3 Wallets and How Does It Work?

Create a Responsive Navbar using ReactJS

Express JS tutorial for beginners

Back to Top Button using jQuery and CSS

Express JS tutorial for beginners

GTA 6 Trailer 2025: Explore Vice City with Lucia - Everything We Know So Far

You may also like…