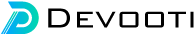

Mastering the Inverse Head and Shoulders Pattern: A Comprehensive Guide

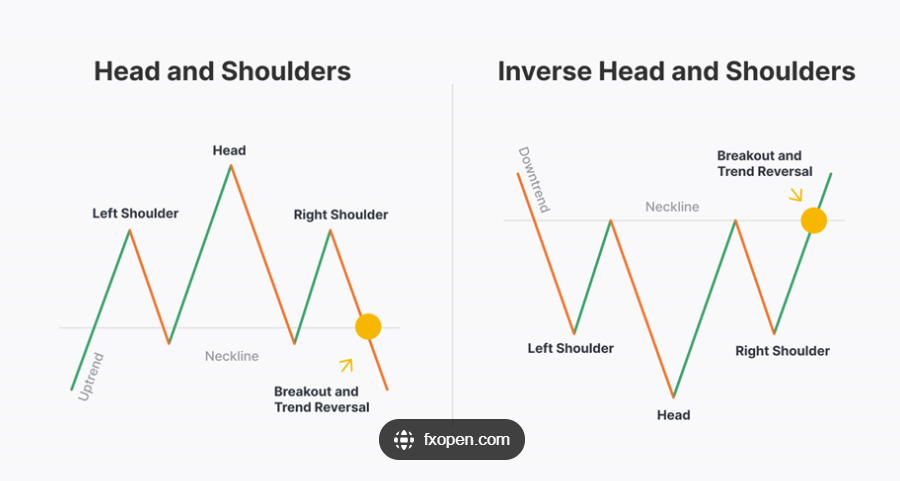

Create a Responsive Navbar using ReactJS

Smooth Scroll to Div using jQuery

Understanding Average Stock Market Returns and Investment Strategies

How to install Tailwind CSS in React

Express JS tutorial for beginners

Understanding Average Stock Market Returns and Investment Strategies

Discovering the Average Stock Market Return and Effective Investment Strategies

What is the Average Stock Market Return?

The average stock market return, historically measured by the S&P 500 index, has been approximately 10% per year over the last century. However, this average is influenced by inflation, causing a real return to be around 7-8% annually.

Market Volatility and Investment Horizon

The stock market is designed for long-term investments, typically spanning at least five years. For shorter durations, lower-risk options like online savings accounts may be more suitable, although the expected return would be lower.

The Fluctuating Nature of Returns

While the average return hovers around 10%, yearly returns rarely fall within this range. Volatility is inherent in the stock market, with positive returns observed in about 70% of years. Despite fluctuations, the market tends to yield positive results over time.

S&P 500 Returns Over Different Timeframes

Examining the S&P 500's returns over 5, 10, 20, and 30-year periods, it becomes evident that annual returns can vary significantly. Historical events like the Great Recession and the dot-com crash influence longer-term returns.

Managing Expectations and Rule of Thumb

While there are no guarantees in the market, the 10% average has remained relatively steady. Investors are advised to temper enthusiasm during prosperous times and become more optimistic during market downturns. A conservative estimate of a 6% average annual return is recommended, acknowledging both up and down years.

Key Takeaways for Successful Investing

- Exercise caution during bull markets and anticipate lower future returns.

- Celebrate market downturns as opportunities to invest at attractive valuations.

- Consistent buy-and-hold strategies tend to yield the average return; frequent trading may result in lower returns due to commissions, taxes, and poorly timed trades.

- Portfolio rebalancing can be beneficial, but minimizing frequent adjustments is crucial for long-term success.

Conclusion:

Taking the First Step Interested in the market's long-term potential? Opening a brokerage account is the initial step, allowing you to engage in stock market investments.

Recent Posts

Mastering the Inverse Head and Shoulders Pattern: A Comprehensive Guide

What are penny stocks, and is it wise to invest in them?

Understanding Average Stock Market Returns and Investment Strategies

Smooth Scroll to Div using jQuery

Back to Top Button using jQuery and CSS

How to install Tailwind CSS in React

How To Use the .htaccess File

What is a Hardware Wallet and How Does it Work?

A Complete Overview of Web3 Wallets and How Does It Work?

Create a Responsive Navbar using ReactJS

Express JS tutorial for beginners

Express JS tutorial for beginners

Back to Top Button using jQuery and CSS

GTA 6 Trailer 2025: Explore Vice City with Lucia - Everything We Know So Far

You may also like…